With a successor director in place, you can rest assured that you or your family maintain control over any businesses you are a director of, even if the worst happens.

It’s a great feeling to see your business thrive under your leadership, but what happens in case of an emergency and you’re no longer able to run your business? You need to have a plan in place for a smooth transition of power.

This is especially important if you are a sole director or a co-director with your business partner. In this article we’ll look into the role of a successor director as well as an alternative director.

Key differences between an alternate director and a successor director

A successor director is a designated individual who will take over the role of a director when the current director resigns, retires, or passes away. Their role is to ensure continuity in the leadership of the company and carry on with the business’s objectives and strategies. Successor directors are typically chosen based on their skills, experience, and ability to lead the company effectively.

For example, if you are a sole director and pass away without a nominated successor director, the future leadership of your business could be decided legally, putting your family’s source of income in jeopardy.

An alternate director, on the other hand, is a temporary replacement for a director who is unable to attend a board meeting or fulfill their duties for a certain period of time. An alternate director is appointed by the board of directors to attend specific meetings and vote on behalf of the absent director. They do not have the same level of authority and responsibility as a regular director or a successor director.

While both roles are important for the smooth functioning of a company, a successor director plays a more significant long-term role in ensuring the company’s future success.

| Alternate Director | Successor Director | |

| Do you need to notify ASIC? | Yes | Yes – it’s a fully-fledged director |

| Power to sign circulating resolutions? | Yes | Yes |

| Power to vote at a meeting? | Yes, only when appointing director is not present | Yes |

| Can this position be counted as one of the total number of directors? | No | Yes |

| To serve in the role, is it necessary to hold the position of a director? | No | Yes |

| If the person who appointed someone to a position loses their capacity or passes away, does the appointed person’s position come to an end? | Yes | The occurrence of these events will automatically result in the appointment of the nominated successor director as an official director. |

When would my company require an alternate director?

Companies may require alternate directors for various reasons, such as when directors have conflicting schedules or are unable to attend meetings due to illness or other personal reasons.

Alternate directors can also be used to prepare for the eventuality that a current director will leave the board. This could happen due to retirement, resignation, or other reasons.

6 key things to consider when appointing a successor director:

Let’s take a closer look at the appointment of a successor director and key things to consider.

- Vested interest: Select a successor director who has a strong stake in your company and will prioritize your interests.

- Skills and expertise: The right person should have the skills and expertise necessary to fulfill the duties of the departing director. They should also have the ability to contribute to the board in a meaningful way.

- Board composition: They should complement the existing board composition and bring a diverse set of skills and perspectives to the board.

- Company culture: It is important that the successor director be familiar with the company culture and values, and should be aligned with the company’s strategic goals.

- Succession plan: The company should have a clear succession plan in place that outlines the process for appointing a successor director, including any necessary approvals from shareholders or other stakeholders.

- Training and development: They should receive appropriate training and development to prepare them for their role on the board.

Do I need an alternate director and a successor director if I am a co-director with my business partner?

You don’t need both but we recommend appointing at least a successor director. Even though you may have a brilliant business partner and co-director it is important to protect the financial interests of your family in the unfortunate event of incapacitation or death. Your co-directors may choose to make business decisions that put their own considerations first over your family’s.

How do I ensure a seamless transition?

It is important to follow these steps when implementing an alternate director or a successor director for your company.

Step 1: Understand the laws

ASIC Information Sheet 73 (INFO 73) provides guidance to help directors and shareholders of small proprietary companies understand their legal obligations and responsibilities. Firstly, having a valid Will in place is vital.

A valid Will can help ensure that the company’s ownership and management are transferred smoothly and efficiently in the event of the sole director or shareholder’s death or incapacity. Without a Will, the transfer of ownership and management may be subject to legal proceedings, which can be time-consuming, costly, and disruptive to the company’s operations.

Step 2: Review the company constitution

It is important for companies to review their constitution and determine whether it provides for the appointment of alternate directors or successor directors. If the constitution does not provide for these appointments, the company may need to amend its constitution to ensure that it can make valid and effective appointments in accordance with the relevant laws and regulations.

The constitution should cover the appointment of directors in the event of death, mental incapacity or bankruptcy and what capacity the alternate directors or successor directors will hold.

Step 3: Is “The Protector” needed?

When someone becomes a director of a company, any assets they own could become at risk if the company is sued or goes bankrupt. This is because the director is responsible for the company’s affairs. To protect the assets of the director, a solution called “The Protector” can be used.

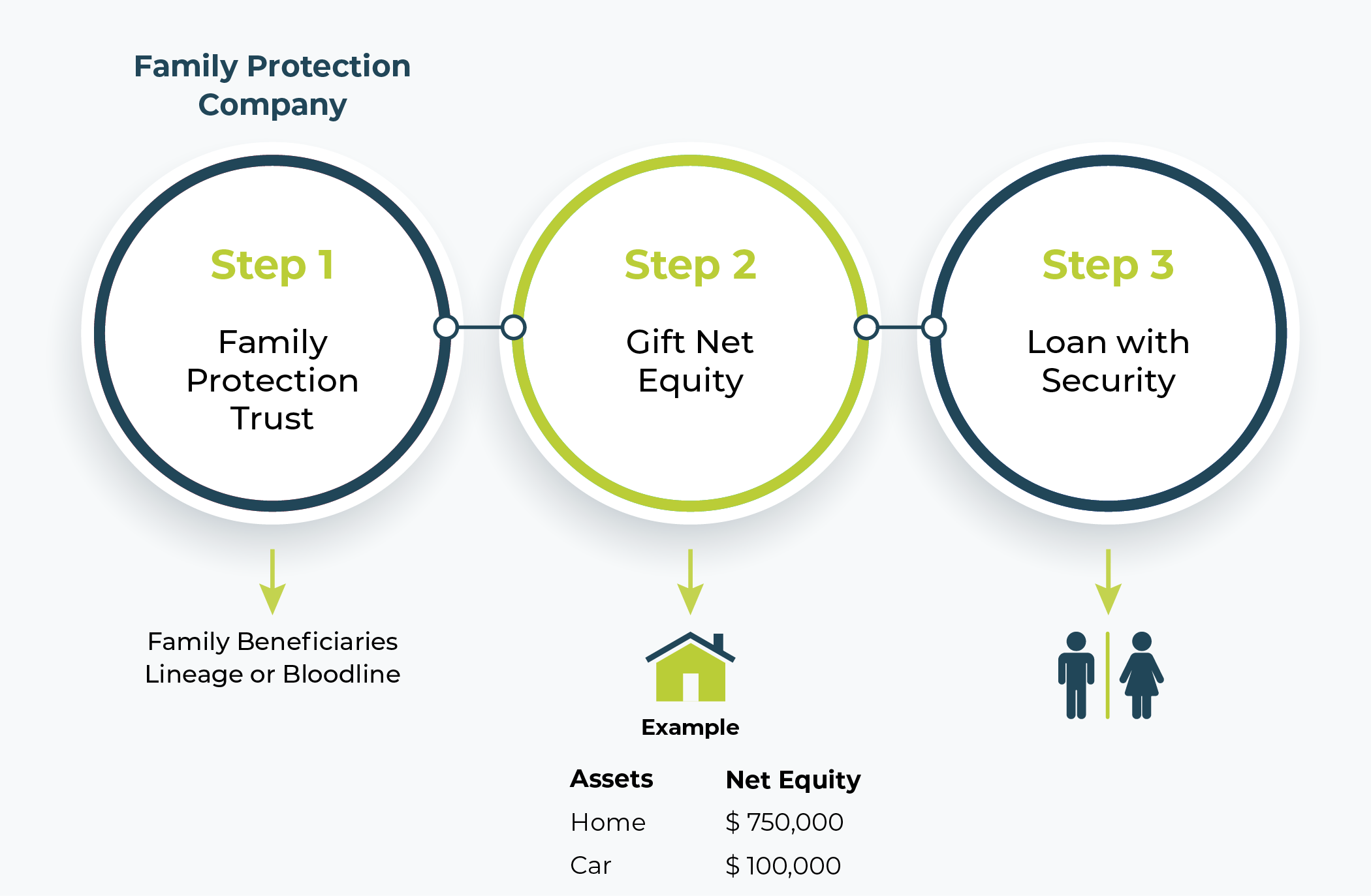

“The Protector” involves setting up a Family Protection Trust and gifting the net equity in the assets to the trust. The trust then provides a loan back to the director and takes security over their assets to protect the loan. This means that the director’s net equity in the assets is now held by the trust and not in their personal name.

This protects their assets from legal action, as most lawyers won’t pursue a legal settlement against someone with little or no assets in their personal name. This strategy can be especially helpful for a successor director who holds valuable assets like properties.

Whether “The Protector” is needed depends on whether the director or successor director holds assets in their name.

Below is an infographic to help explain “the family protection trust”:

Step 4: The successor director system

To secure a smooth transition of company leadership, it is important to have a clear plan in place. This involves creating a resolution to officially appoint a successor director and alternate director, making sure it aligns with the company’s constitution.

By taking these steps, the company can ensure that the appointment of directors and the transition of power are seamless. It is important that the new directors are able to step into their role with confidence and clarity.

Protecting your family

It’s important to have a plan in place for unexpected events like emergencies or death, to protect your family’s future and wealth. Although it’s difficult to think about these situations, preparing for them is essential.

If you’d like to know more about the process of appointing a successor director please speak to the team at creditte chartered accountants & advisors today – don’t wait until it’s too late.

We will ensure the protection of control over the assets in all your companies and your trusts which have trustee companies.

Contact us today to schedule a free discovery call.